2025 Shareholder Proposal Season: A First Glimpse at Key No-Action Request Results

Introduction

After last year’s resurgence in both the submission rate and success rate of no-action requests for Rule 14a-8 shareholder proposals, the 2025 proxy season* saw a marked surge in the submission of no-action requests, while success rates appear to have remained roughly level with 2024. In February, the Staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) published guidance in Staff Legal Bulletin 14M (“SLB 14M”), reinstating standards based on Commission statements that preceded Staff Legal Bulletin 14L (“SLB 14L”). The following discussion highlights some of the key preliminary takeaways from the 2025 no-action request process.

Overview of No-Action Requests During the 2025 Proxy Season

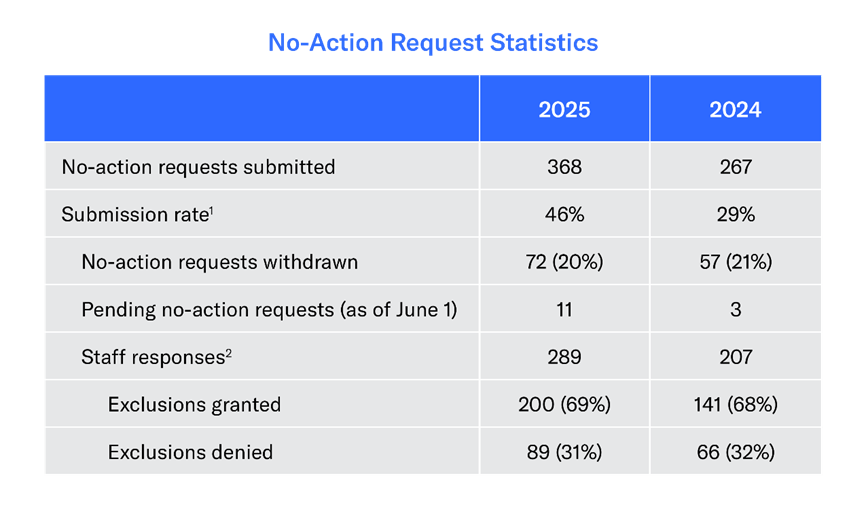

- Submission, success and withdrawal rates. Continuing the trend from the 2024 proxy season (in which the number of shareholder proposals challenged in no-action requests rebounded to pre-2022 (and pre-SLB 14L) levels), the number of no-action requests rose again during the 2025 proxy season, up 38% compared to 2024. The Staff granted approximately 69% of no-action requests in 2025, which was relatively steady with the 68% success rate in 2024, signaling a continued trend of returning to the success rates in 2021 and 2020 (71% and 70%, respectively). However, looking more closely at 2025’s steady success rate reveals that it was driven in part by the successful exclusion of 37 proposals submitted by the same proponent—32 of which were excluded on procedural grounds and five of which were excluded on Rule 14a-8(i)(7) (under the “ordinary business” exception). Notably, those 37 wins represent over 18% of all successful no-action requests during the 2025 season.

The number of no-action request withdrawals increased by 26% in 2025 compared to 2024, although the withdrawal rate decreased slightly, from 21% of all no-action requests in 2024 to 20% in 2025, due to the sharp increase in the number of no-action requests submitted in 2025.[1][2]

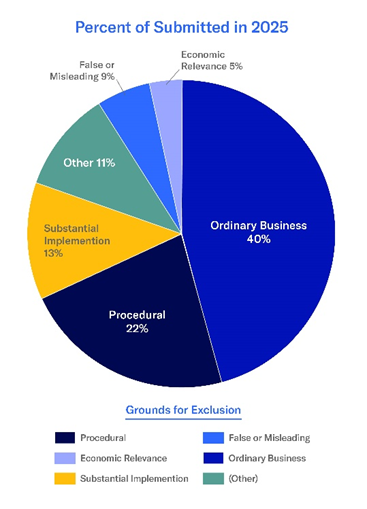

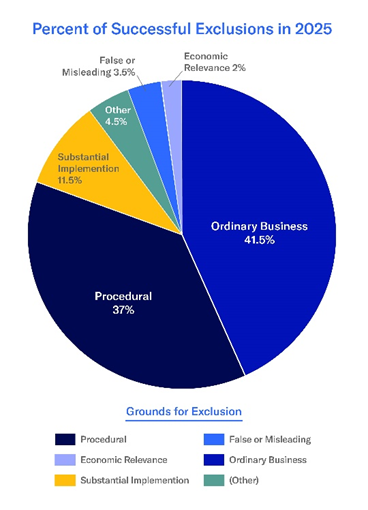

- Most common no-action arguments and success rates. The graphics below reflect the most common arguments for exclusion in 2025 and the percentage of successful exclusions based on these arguments. As in recent years, in 2025 ordinary business and substantial implementation continued to be the most argued substantive grounds for exclusion. During the 2025 season, the Staff most often granted no-action requests based on ordinary business (representing 41.5% of successful requests),[3] procedural (representing 37% of successful requests),[4] and substantial implementation (representing 11.5% of successful requests) grounds. Notably, 90% of successful no-action requests in 2025 were based on one of these three grounds, reflecting a continued narrowing concentration of the grounds on which successful requests have been granted in recent years. In addition, while the Staff declined to concur with most substantial implementation arguments in recent years, more than 50% of the substantial implementation no-action requests were granted in the 2025 season.

![]()

SLB 14M and Its Immediate Impact

- On February 12, 2025, the Staff published SLB 14M, which rescinded SLB 14L (issued in November 2021). SLB 14M marked a return to a more traditional administration of the shareholder proposal rule, particularly as it realigned the Staff’s approach to Rule 14a-8(i)(5) (the “economic relevance” exception)[5] and arguments based on the first consideration of Rule 14(i)(7), the “ordinary business” exception,[6] with past Commission statements interpreting Rule 14a-8, and reaffirmed the application of the “micromanagement” exception under the second consideration of Rule 14a-8(i)(7).[7]

Most notably, SLB 14M aimed to reinvigorate the economic relevance exception by stating that the Staff will base its administration of the rule on the objectives announced by the Commission when it adopted the current rule’s language and affirming that the Staff will take a company-specific approach of evaluating whether the subject matter of a proposal is “not otherwise significantly related to the company” under the economic relevance standard and when determining the significance of a policy issue raised by a shareholder proposal for purposes of the ordinary business exclusion.

In SLB 14M, the Staff stated that companies could submit new no-action requests or supplement existing no-action requests after their deadlines to address the SLB 14M guidance. Twenty-seven new substantive no-action requests were submitted under SLB 14M after the company’s original no-action request deadline with “good cause,” and 29 supplemental letters were submitted following the publication of SLB 14M in connection with pending no-action requests. Nearly all of the new no-action requests submitted with “good cause” and supplemental letters made new, or clarified existing, economic relevance and/or ordinary business arguments.

Although SLB 14M marked the Staff’s return to a more traditional application of Rule 14a-8 that many observers view as more company-friendly, the results of the 2025 season demonstrate that SLB 14M does not provide companies with a blank check to exclude proposals under the economic relevance or ordinary business exceptions. Of the no-action requests based on the first consideration of the ordinary business exception that the Staff decided following the publication of SLB 14M, 57% were successful (below the overall 69% success rate). No-action requests arguing micromanagement had a somewhat lower success rate of 52%. Economic relevance arguments had less success, with only a 30% success rate on four such requests decided following the publication of SLB 14M.

Continued Resurgence in Successful Micromanagement Arguments

- Continuing a trend that emerged in the 2024 proxy season, before SLB 14M was issued, the Staff continued to be receptive to micromanagement arguments under Rule 14a-8(i)(7), which have increased as proponents submitted increasingly prescriptive proposals. This is best reflected in the November 2024 Air Products and Chemicals, Inc. letter, where the company successfully excluded on micromanagement grounds a proposal requesting an extensive and detailed report on the company’s lobbying practices, which is one of the most common civic engagement shareholder proposals of the last decade.[8] Notably, prior to the Air Products decision, lobbying proposals had not been successfully excluded on micromanagement grounds. In its challenge, Air Products argued that the proposal sought to micromanage the company by requesting a highly prescriptive and detailed report seeking over 79 distinct pieces of information and would be unduly burdensome because it would require granular disclosure of the prescribed lobbying activities without regard to their significance to the company’s operations and overall government relations activities. Following the Air Products decision, 24 companies sought the exclusion of similar traditional lobbying proposals on micromanagement grounds. Of these requests, 16 proposals were successfully excluded on micromanagement grounds and eight proposals were withdrawn.

Successful Challenges to False and Misleading Statements and Statements Questioning Directors’ Qualifications

- In two instances this season, proposals were excluded due to the inclusion of materially false and misleading statements and statements questioning the competency, business judgment and character of a director nominee in the proposals’ supporting statements. In recent years, both of these bases for exclusion appeared to have become dead letters. However, in 2024, the Staff concurred with the exclusion of an independent chair proposal under Rule 14a-8(i)(8) where the proposal’s supporting statement named a specific director and questioned that director’s competence and business judgment. The 2025 season’s two successful no-action requests signal the Staff’s willingness to consider false information and certain derogatory statements included in a proposal’s supporting statement as providing a basis for exclusion of an entire proposal.

In this season’s first instance, a company was able to exclude a proposal under Rule 14a-8(i)(3), where the proposal’s supporting statement confused the company’s current independent lead director with the company’s prior independent lead director, rendering the entire proposal false and misleading and materially affecting a shareholder’s consideration of how to vote on the proposal. In the second instance, a company was able to exclude the proposal under Rule 14a-8(i)(8), where the proposal’s supporting statement questioned the lead independent director’s business judgment and competence by stating that the director is “operating outside of her league” and is “poorly qualified.”

Spotlight on No-Action Requests Challenging Politicized Proposals

- As anti-ESG sentiment has grown in recent years, including the recent scrutiny of diversity and discrimination-related issues, there has been an uptick in the submission of proposals that focus on conservative perspectives on these and other topics. At the same time, proponents on the other side of the political spectrum have continued to submit proposals reflecting a liberal perspective on ESG, DEI and other topics.[9]

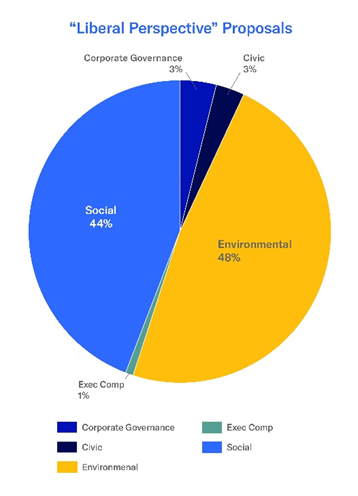

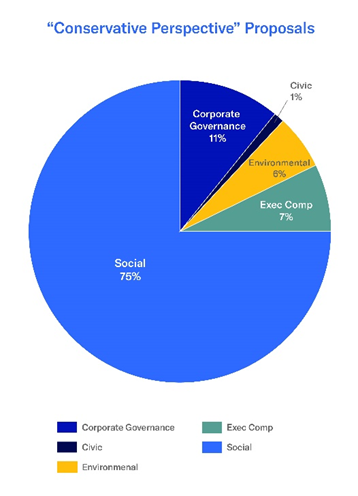

- The majority of proposals reflecting liberal perspectives challenged by no-action requests this season related to environmental (48%) and social (44%) topics. The most common challenged environmental proposals reflecting liberal perspectives concerned climate change. The most common challenged social proposals reflecting liberal perspectives related to workforce, human rights, discrimination and diversity matters. A significant majority (75%) of the challenged proposals reflecting conservative perspectives related to social issues, specifically discrimination-related matters.

Successful Grounds for Excluding Politicized Proposals

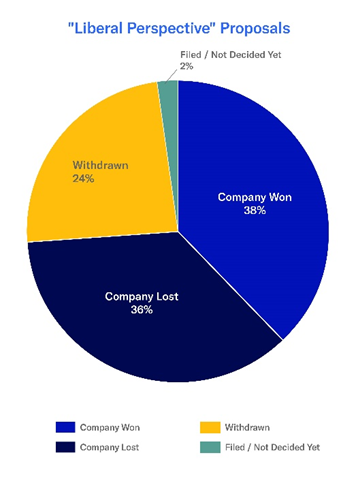

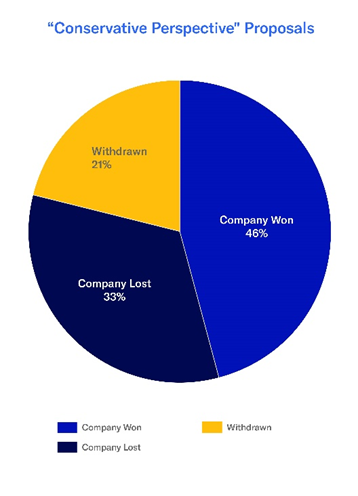

- Consistent with overall results, ordinary business (including both matters relating to the company’s ordinary business and micromanagement arguments) and substantial implementation arguments were the most successful substantive grounds for excluding both proposals reflecting liberal and conservative perspectives. Overall, excluding withdrawals, 58% of the no-action requests challenging proposals reflecting conservative perspectives were successful in the 2025 proxy season, as compared to a success rate of 51% for proposals reflecting liberal perspectives. Withdrawal rates were similar across the two categories of proposals. However, close analysis suggests that results were driven by the specific terms of the proposals, and not by political perspectives. For example, 57% of the social policy proposals reflecting liberal perspectives were excluded, compared to 51% of the social policy proposals reflecting conservative perspectives. Among proposals excluded on ordinary business grounds, proposals reflecting conservative perspectives were notably more likely to be excluded as relating to the company’s ordinary business, while proposals reflecting liberal perspectives were somewhat more likely to be excluded on micromanagement grounds. This suggests that the Staff’s responses to arguments made regarding politicized proposals reflect the specific approach and substance of the proposal. Companies appear to have received a narrower range of proposals reflecting conservative perspectives, which, when excludable under Rule 14a-(i)(7), primarily focused on subject matters that the Staff viewed as in the purview of management instead of shareholders. On the other hand, as reflected in the chart above, companies received a wider range of proposals reflecting liberal perspectives. Of the proposals reflecting liberal perspectives that the Staff found to be excludable under ordinary business grounds, over half were too prescriptive or granular in their approach, and thus excludable as micromanagement.

Conclusion

The 2025 proxy season unfolded against a backdrop of political and regulatory change—most notably the issuance of SLB 14M and a surge in proposals reflecting differing perspectives on environmental and social policy issues. As such, the no-action request results during the 2025 season provide a number of preliminary insights into the future application of Rule 14a-8 and the no-action request process under the Commission’s new leadership. However, as SLB 14M was issued during the height of the 2025 proxy season, the full impacts of the Staff’s guidance may not yet be fully discernable. Moreover, there may be even more change in store for Rule 14a-8 and the no-action request process under the leadership of the Commission’s new Chairman, Paul S. Atkins. Another full shareholder proposal season under SLB 14M and the Atkins Commission will shed additional light on the Staff’s current approach to the no-action request process and the application of Rule 14a-8 more broadly.

* For purposes of reporting statistics regarding no-action requests, references to the 2025 proxy season refer to the period between October 1, 2024 and June 1, 2025.Data regarding no-action letter requests and responses was derived from the information available on the SEC’s website.

1

2

3

4

5

6

7

8

9

![]()

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.